Barely days after the implementation of the new tax laws, Nigerians have raised concerns over what they describe as double stamp duty deductions by banks since January 1, 2026.

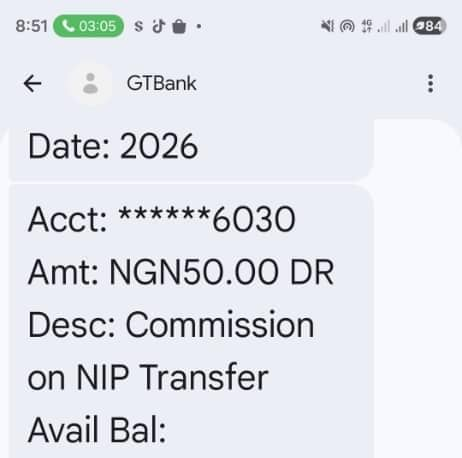

DAILY POST reports that Nigerian banks began enforcing the ₦50 stamp duty charge on electronic transfers of ₦10,000 and above at the start of the year. Customers across various financial institutions received notifications informing them of the uniform ₦50 deduction in line with the new tax regime.

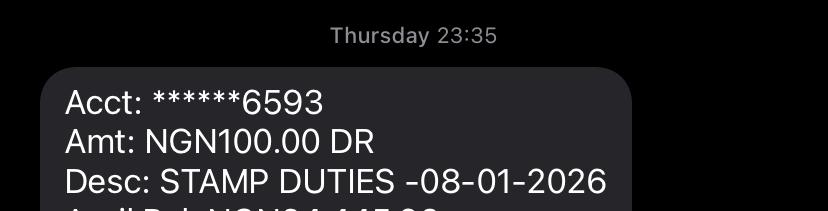

However, less than two weeks into the policy’s rollout, many bank customers allege that their accounts are being excessively debited. Several Nigerians who spoke to DAILY POST anonymously claimed they were charged ₦100 per ₦10,000 transfer, rather than the officially stated ₦50.

“It is unfair that instead of ₦50 per ₦10,000 transfer, my bank deducted ₦100 as stamp duty last week, especially considering the harsh economic conditions,” a customer of a leading commercial bank said.

Another customer threatened legal action, accusing his bank of repeatedly deducting stamp duty charges from his account.

“I’m ready to take action or call out my bank publicly over these multiple deductions. They informed us it would be ₦50, yet ₦100 is being taken. That’s unacceptable,” he said.

Efforts to reach Dr. Uju Ogunbunka, President of the Bank Customers’ Association of Nigeria, were unsuccessful, as he did not respond to calls or messages as of the time of filing this report.

Likewise, the Central Bank of Nigeria has yet to issue an official response to claims of double stamp duty deductions by banks.

Meanwhile, speaking with DAILY POST on Monday, Professor Godwin Oyedokun of Lead City University, Ibadan, urged Nigerians to avoid confusing stamp duty charges with other bank deductions. He explained that in his own experience, the ₦100 debit reflected both stamp duty and Nigeria Inter-Bank Settlement System (NIP) transfer fees.

“People should be careful not to misinterpret bank charges. Sometimes banks consolidate deductions, making it appear as though customers are being overcharged,” he said.

According to him, the ₦50 NIP transfer fee is separate from the ₦50 stamp duty, stressing that the issue should not be misrepresented as a tax-related problem or used to undermine the government.

Recalls that since the tax reform bills were introduced to the National Assembly in October 2024, signed into law by President Bola Ahmed Tinubu in June 2025, and eventually implemented, they have been surrounded by controversy.

Most recently, concerns were raised over alleged errors and gaps identified by KPMG, although the Federal Government has dismissed doubts about the integrity of the tax laws.