The North will not be comfortable with Christian-Christian ticket - APC chieftain

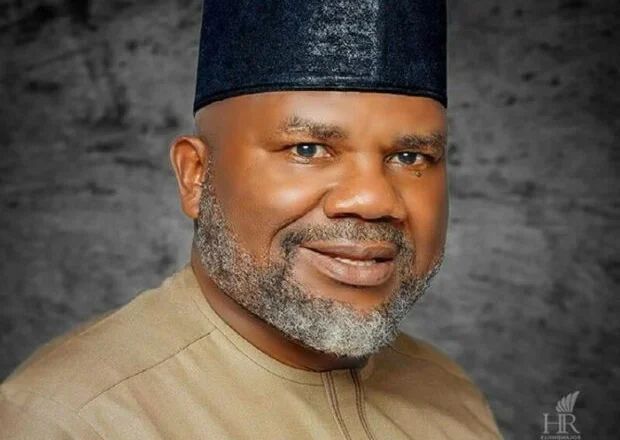

A chieftain of the All Progressives Congress (APC), Farouk Aliyu, has said the North would not be comfortable with a Christian-Christian presidential ticket as such a pair combination will alienate Muslim voters in the region.

Aliyu spoke on Friday during an interview on ARISE Television while reacting to debates on whether the ruling party should retain or alter the Muslim-Muslim ticket that produced President Bola Tinubu and Vice-President Kashim Shettima in 2023.

“In my opinion, the numbers will be looked at whether to field a Muslim or a Christian, the numbers are there to show.

Whether in the northern part of the country there are more Muslims, it is absolutely without doubt that there are more Muslims. So any party can decide to field a Christian, but if it goes in terms of...